Rumored Buzz on Commercial Insurance In Dallas Tx

Wiki Article

Some Of Life Insurance In Dallas Tx

Table of ContentsHow Commercial Insurance In Dallas Tx can Save You Time, Stress, and Money.5 Simple Techniques For Home Insurance In Dallas TxThe Facts About Life Insurance In Dallas Tx RevealedThings about Health Insurance In Dallas TxSee This Report on Life Insurance In Dallas Tx7 Simple Techniques For Insurance Agency In Dallas Tx

The premium is the amount you pay (generally monthly) for health and wellness insurance policy. Cost-sharing refers to the portion of qualified health care costs the insurance company pays as well as the section you pay out-of-pocket. Your out-of-pocket expenditures may include deductibles, coinsurance, copayments and also the full price of medical care solutions not covered by the strategy.High-deductible plans cross classifications. Some are PPO strategies while others might be EPO or HMO strategies. This kind of medical insurance has a high insurance deductible that you need to fulfill prior to your health insurance policy protection takes result. These strategies can be appropriate for individuals that intend to conserve cash with reduced month-to-month costs and also do not intend to utilize their clinical insurance coverage thoroughly.

The drawback to this kind of protection is that it does not satisfy the minimum vital protection needed by the Affordable Treatment Act, so you may likewise go through the tax obligation penalty. On top of that, short-term plans can exclude insurance coverage for pre-existing problems. Temporary insurance policy is non-renewable, and also does not consist of coverage for preventative care such as physicals, vaccines, oral, or vision.

Commercial Insurance In Dallas Tx Fundamentals Explained

Consult your very own tax, bookkeeping, or legal consultant rather than depending on this short article as tax obligation, bookkeeping, or legal recommendations.

You can commonly "leave out" any kind of family participant who does not drive your cars and truck, however in order to do so, you need to submit an "exclusion type" to your insurance company. Drivers who only have a Student's Authorization are not called for to be listed on your plan until they are totally accredited.

Things about Home Insurance In Dallas Tx

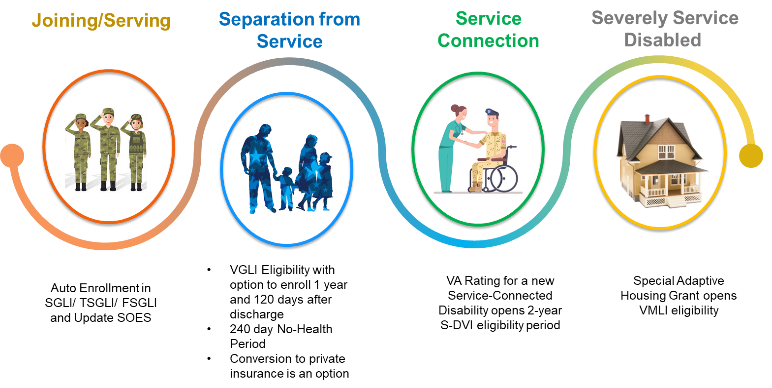

You need to acquire insurance coverage to secure on your own, your family, as well as your wide range (Life insurance in Dallas TX). An insurance plan could conserve you thousands of bucks in the event of a crash, ailment, or catastrophe. As you hit specific life landmarks, some policies, consisting of health and wellness insurance and car insurance policy, are essentially required, while others like life insurance policy and handicap insurance are strongly urged.Crashes, health problem as well as calamities occur regularly. At worst, occasions like these can dive you into deep financial mess up if you don't have insurance coverage to draw on. Some insurance coverage policies are unavoidable (assume: auto insurance policy in a lot of US states), while others are just a smart financial choice (think: life insurance policy).

And also, as your life modifications (say, you get a brand-new task or have a baby) so should your coverage. Listed below, we've described briefly which insurance protection you need to highly think about purchasing every stage of life. Note that while the policies below are prepared by age, obviously they aren't ready in rock.

The Main Principles Of Truck Insurance In Dallas Tx

Below's a quick overview of the policies you need and also when you require them: Many Americans need insurance policy to manage medical care. Selecting the strategy that's right for you may take some research study, however it functions as your very first line of protection versus medical financial debt, among biggest sources of debt among consumers in the United States.In 49 of the 50 US states, drivers are required to have auto insurance to cover any kind of potential building damage and physical injury that might arise from a mishap. Cars and truck insurance coverage rates are largely based on age, credit report, cars and truck make as well as model, driving document as well as location. Some states also take into consideration gender.

Check This Out

Not known Factual Statements About Home Insurance In Dallas Tx

An insurer will consider your home's location, in addition to the dimension, age as well as build of the home to identify your insurance policy costs. Homes in wildfire-, twister- or hurricane-prone areas will often command greater costs. If you offer your home and go back to renting out, or make various other living setups (Home insurance in Dallas TX).

For individuals that are aging or impaired and need aid with day-to-day living, whether in an assisted living home or with hospice, long-lasting care insurance policy can assist take on the inflated expenses. This is the kind of point people don't think of till they grow older and understand this may be a fact for them, however of course, as you obtain older you get extra costly to insure.

For the a lot of part, there are two kinds of life insurance coverage prepares - either term or irreversible plans or some mix of the 2. Life insurance firms use various types of visite site term plans and also standard life policies along with "rate of interest sensitive" products which have come to be much more prevalent considering that the 1980's.

Not known Details About Commercial Insurance In Dallas Tx

Term insurance policy gives security for a given amount of time. This duration might be as short as one year or provide insurance coverage for a details variety of years such as 5, 10, 20 years or to a defined age such as 80 or sometimes as much as the oldest look at these guys age in the life insurance policy death tables.

The longer the warranty, the higher the first costs. If you die throughout the term duration, the company will certainly pay the face amount of the plan to your recipient.

Report this wiki page